BRIX BFSI

Success stories

BRIX has helped over 20 banks, insurance companies and other financial institutions optimize their business processes, reduce costs, adopt customer-oriented approach, and gain competitive advantage. This solution is created based on BRIX’s vast experience in driving innovation across the banking sector, insurance companies and private pension funds.

BRIX BFSI loan pipeline

Capture a new lead

Website

Email

Meeting

RBS

Messengers

Phone

CallCross

sellingMarketing

campaignsSocial

media

Enter customer data

Verify customer information

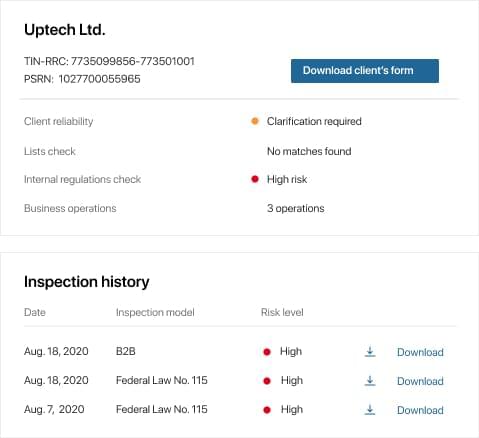

Assess customer risks in Kontur.Prizma

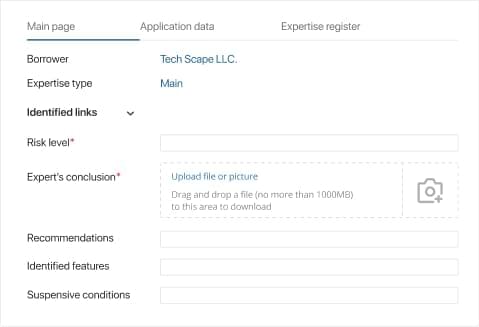

Expert assessment

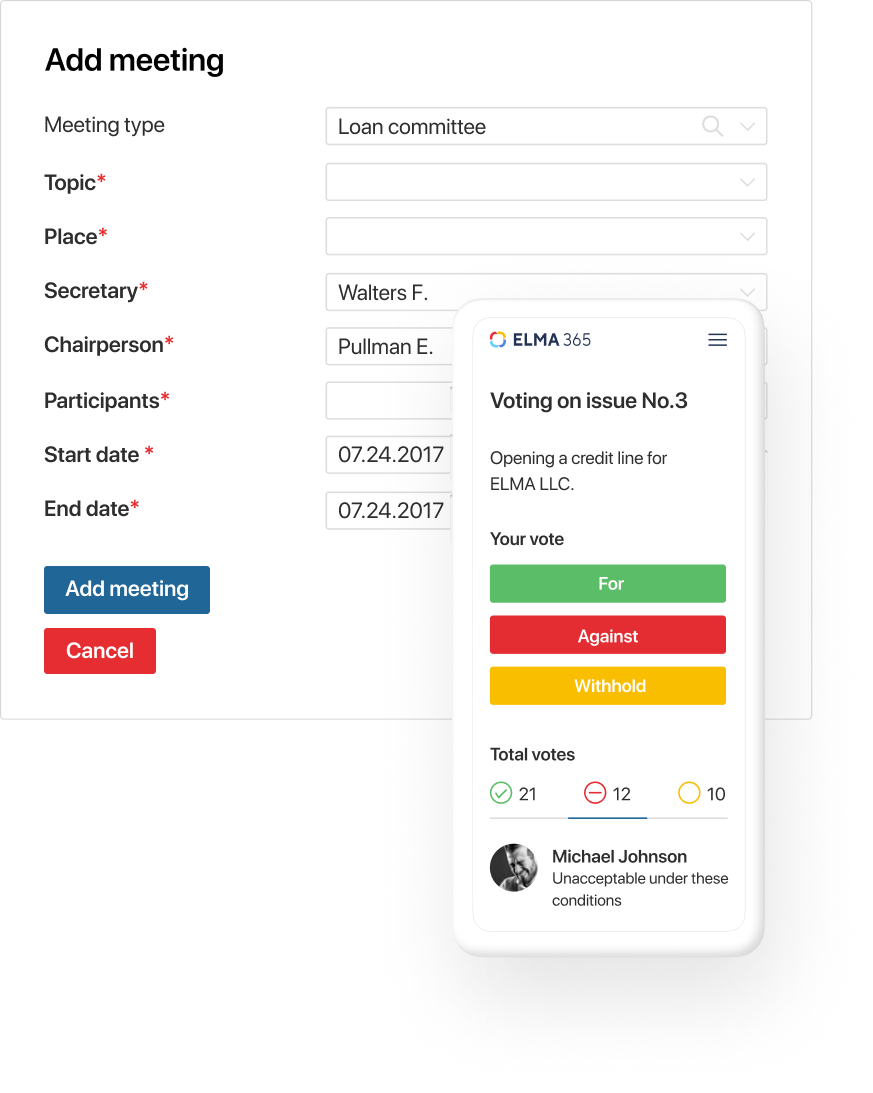

Committee decision

documents

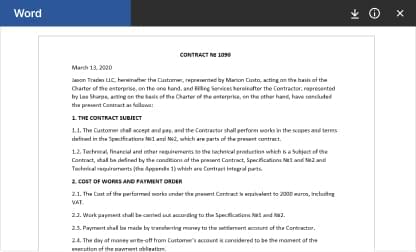

Automatically generate documents

and approval routes

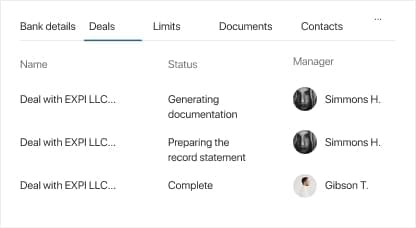

The entire customer history

stored on one page

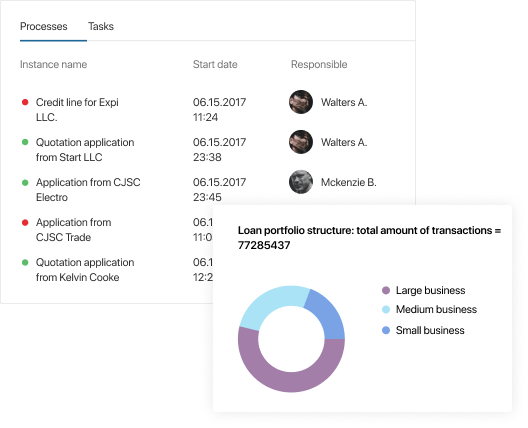

Online charts with report

specification

Read more in Business process analytics

Schedule a presentation

to learn more about

BRIX BFSI

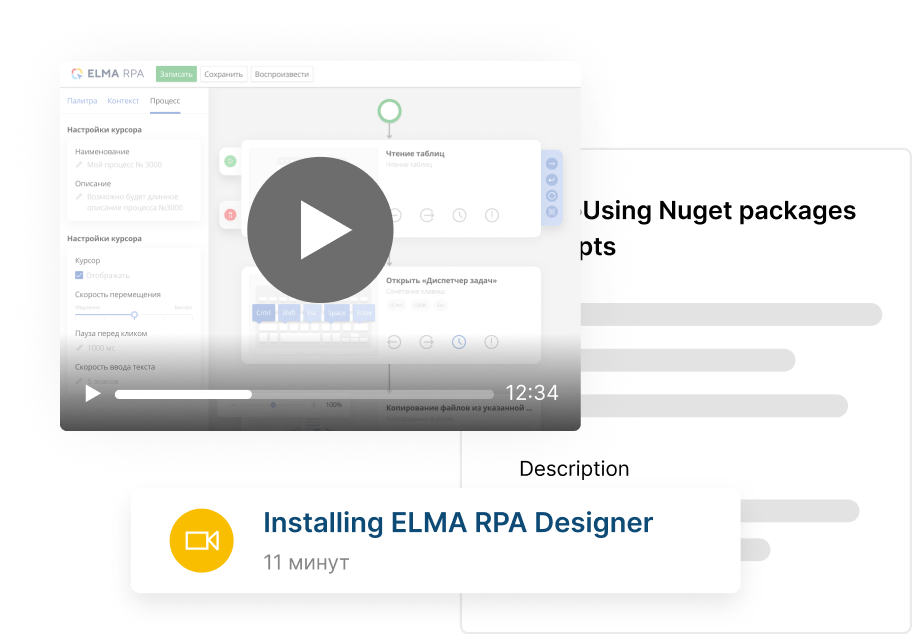

Low-code advantages

The BRIX solution incorporates modern technologies for managing business

processes of financial organizations.

Fast product launch

that only takes two weeks from creating technical requirements to launching the product

No-code system configuration

by analysts and citizen developers. No need to engage the ever-busy IT department

Single-window analytics

with a quick interface and a complete customer history

Customer services and assistance

Opening an account, RBS, foreign exchange control, deposits, and other 50+ products and processes for providing the best customer service.

BRIX BFSI allows creating processes on a single platform instead of randomly using the pipeline, Service Desk, your automated banking system, and emails. A simple analysis of the departments’ efficiency allows you to find the bottlenecks of your processes and improve them. Employees get all the information in a single window, which also speeds up and facilitates the onboarding.

A new business process can be launched in production in just two weeks from the moment the hypothesis was made. Thus, BRIX helps financial organizations improve service quality and speed, develop the customer-focused approach, and reach a competitive advantage.

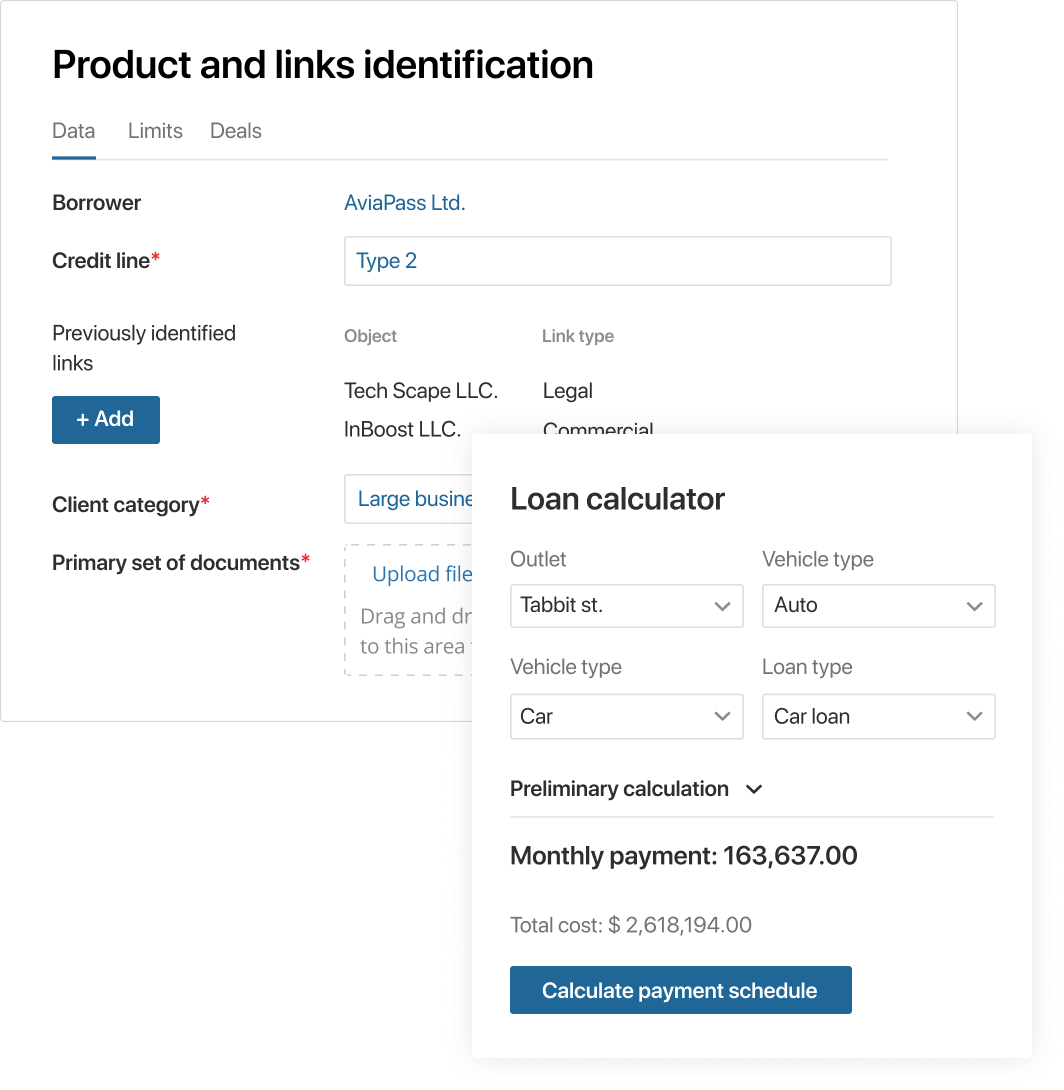

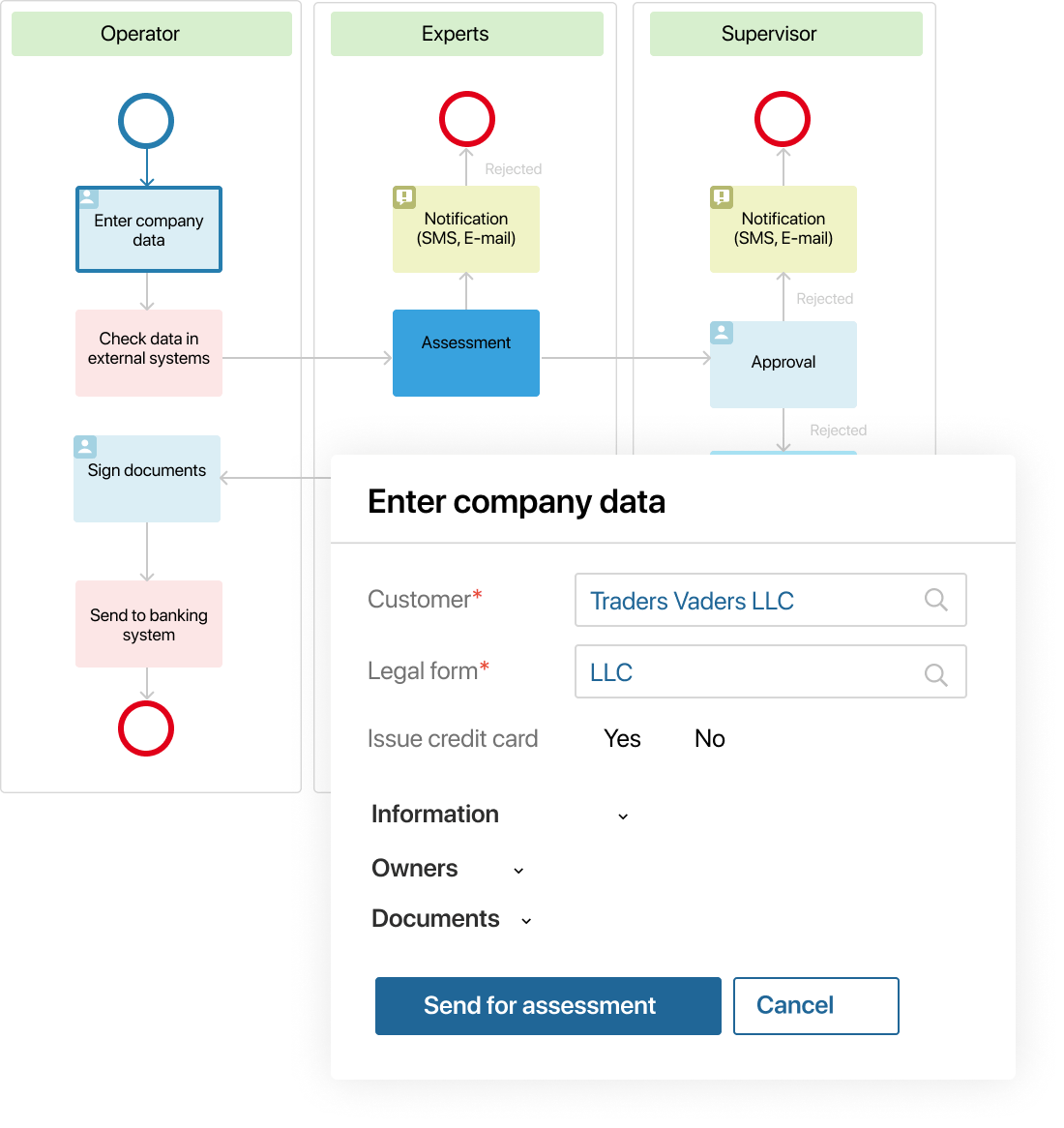

Loan pipelines

Generating leads from external sources, identifying groups of related persons or borrowers, scoring, monitoring, business review, expert assessment reports, underwriting, managing customer information files, loan committees, and preparing reports and documents.

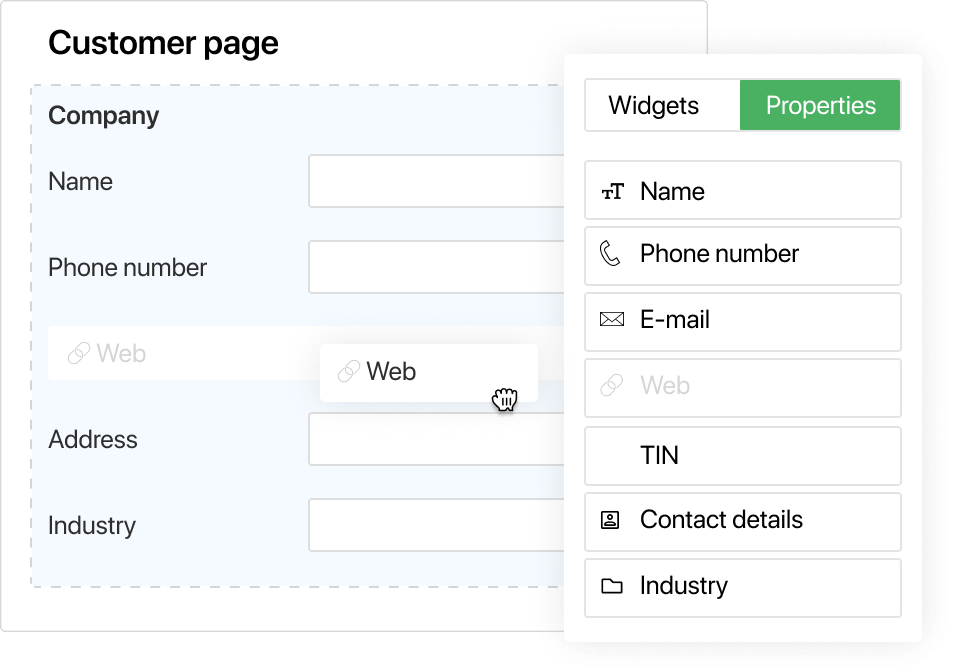

There are processes in each organization, and only the company employees know how they should work. In BRIX BFSI, users can build custom solutions in an intuitive process designer and create personalized screen forms. Methodologists and analysts can change the parameters of the risk models and verifications in the web interface. They don’t need to have any programming skills or wait for maintenance.

To make the solutions affordable, you can use the ready-made connectors for automated banking system and OCR verification systems. For example, "Kontur.Fokus", "Kontur.Prisma", "SPARK", Credit Registry, Credit Bureau, Federal Bailiff Service, Casebook, Federal Tax Service, Federal Financial Monitoring Service, Federal Migration Service, Zakupki.gov.ru, Center of Financial Technologies, and others.

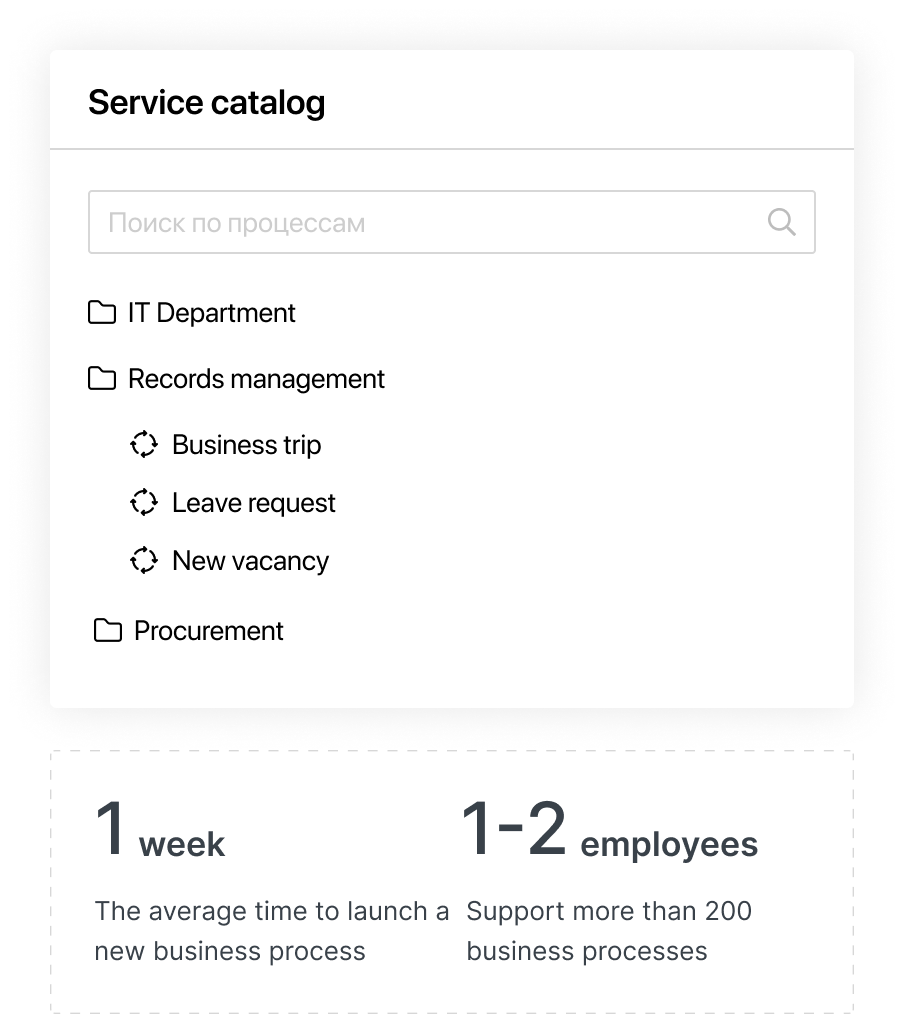

Internal processes and back office

Maintenance and supply department, purchases, IT processes, HR processes, legal support, etc.

BRIX BFSI helps understand the workload of the employees and significantly reduce repetitive manual operations. The low-code designer allows you to digitize all the back-office processes rapidly and at low cost. On average, it takes only one week to implement a new business process.

Process maintenance costs are also quite low. One or two employees can handle more than 200 business processes as they don't need coding skills for that, the process can be changed in just a few clicks.

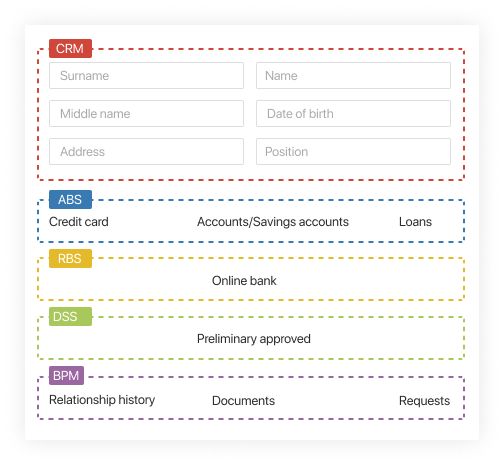

A single window

Access the data from multiple systems in a single window. You don’t need to switch between programs because the information is kept in a single space.

Employees make fewer mistakes because they don’t need to learn how to work in multiple systems. BRIX BFSI increases the speed of decision making and improves customer service.

How BRIX solves your

challenges

High cost of system maintenance and enhancement

Development and maintenance of business processes with a complex logic requires highly qualified experts, each fulfilling their own role

Single low-code platform

Built-in connectors for external test and automated banking systems reduce setup costs. The system consumes less server resources, does not require expensive hardware and software

Introduction of new features takes up to several months

Making any change in the system requires help of the IT department whose backlog is packed for months ahead

Form builder and business rules editor

Processes are changed in no time and new products are created without coding

No real performance data

The process performance measurement focuses on the number of escalations instead of using actual data

Report builder

Custom reports that reflect performance data for each company division

Inconsistent information storage

Customer data is stored in different apps, spreadsheets, emails and messengers, making it impossible to find the right information and the right time

Company portal

Shared company portal that provides access to corporate apps and resources. Accessible from any division or branch office.